Posted on

December 1, 2019

by

Sam Wyatt Personal Real Estate Corporation

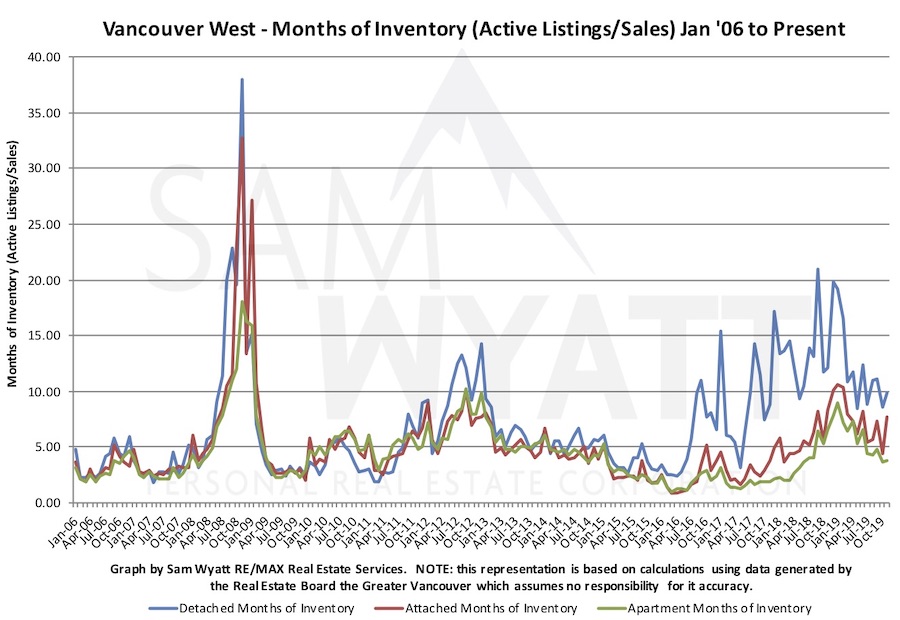

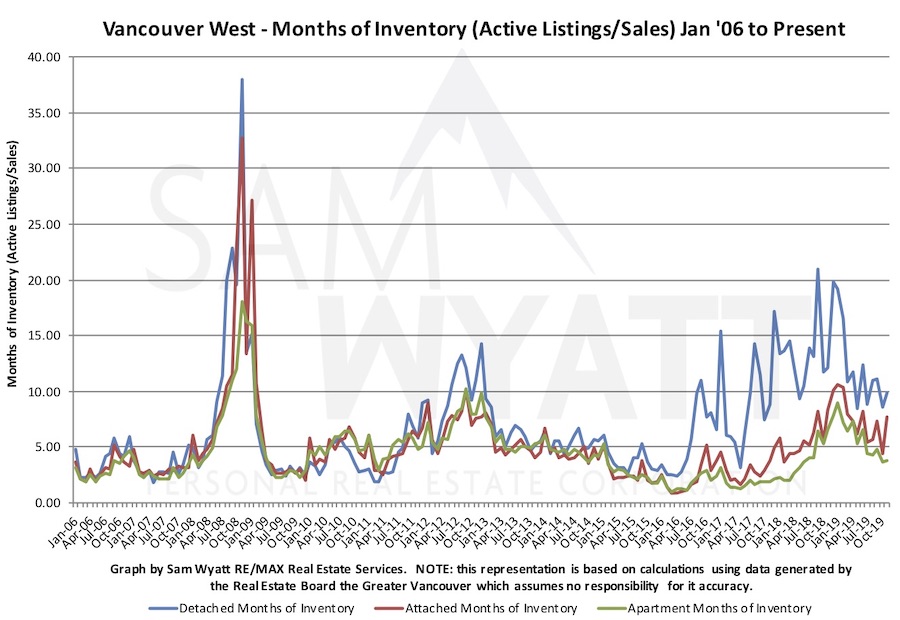

Months of inventory (MOI)* began 2019 in double digits for detached Vancouver Westside homes and remained elevated for most of the year. In fact, detached homes MOI has been in double digits for 19 of that past 24 months. Attached homes and apartments MOI started lower and apartments crossed into a buyer's market in July. All home types' MOI trended downwards this year.

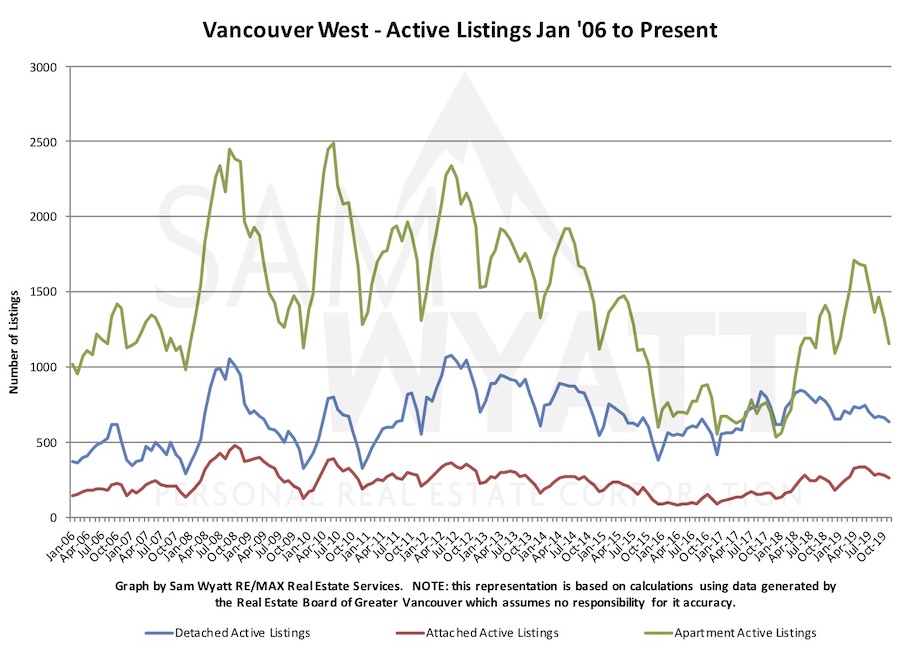

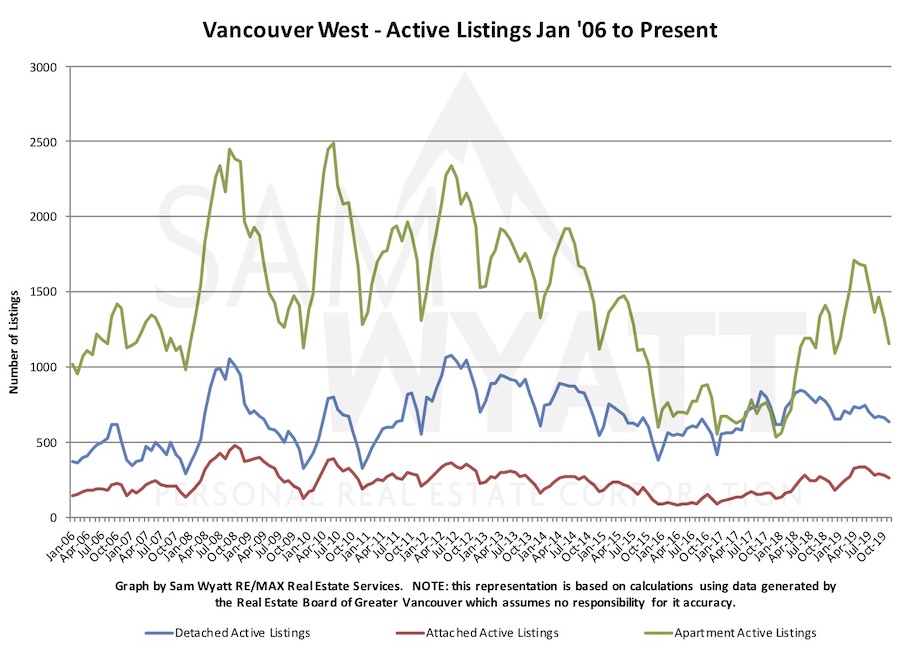

All home types have had fairly typical active listing volumes this year.

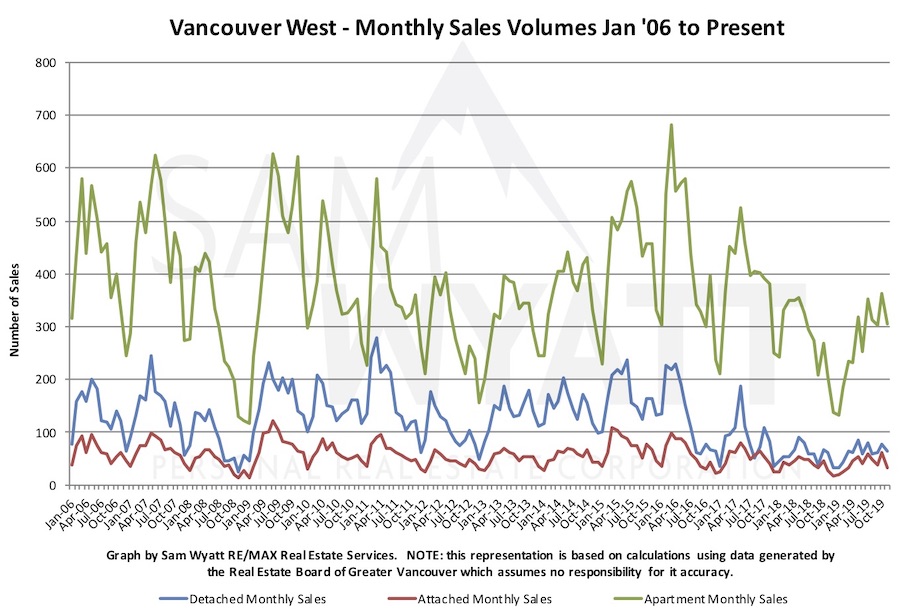

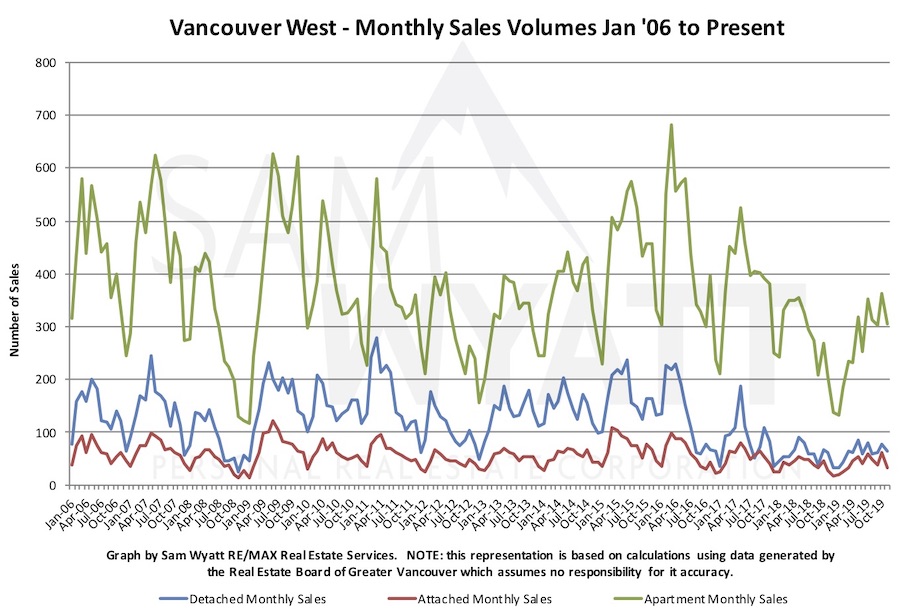

Sales volumes have remained persistently lower than typical for detached homes while apartments and attached homes have had volumes closer to typical. Interestingly, Sales volumes were at their high point for this year in October for apartments. It is unusual to see sales volumes rising so late in the calendar year.

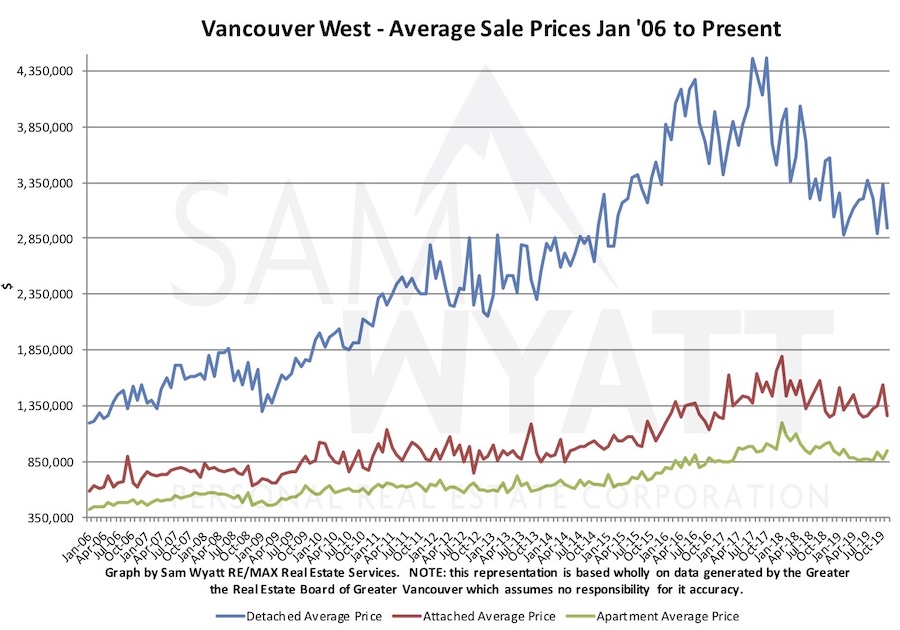

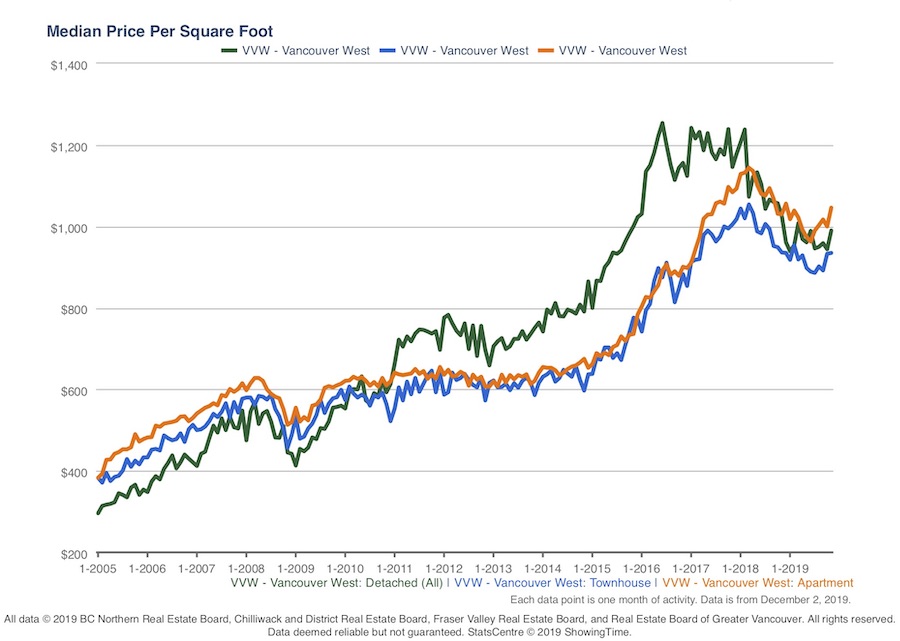

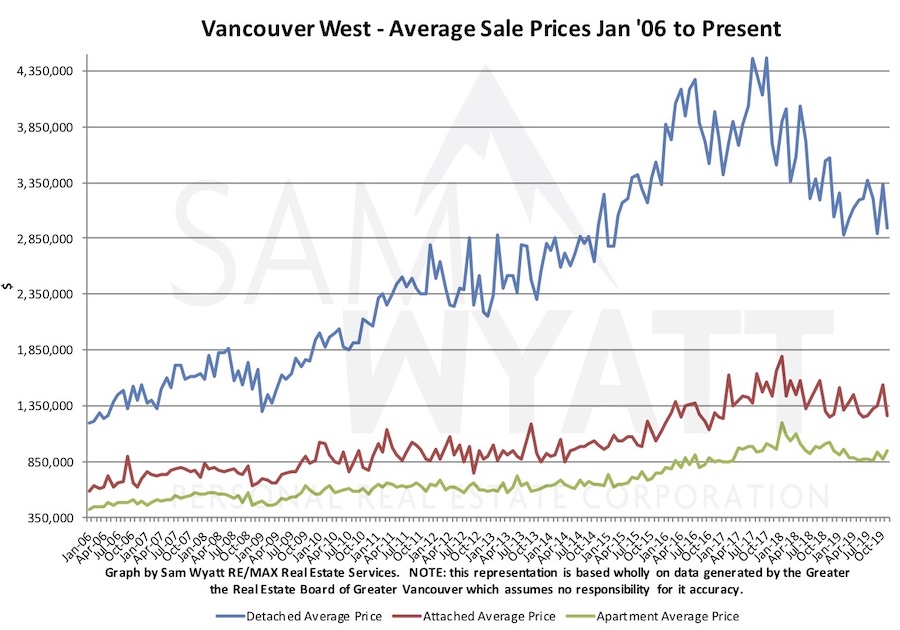

Average sale prices for Westside houses have fallen nearly 35% from their high point of $4,466,841 in October 2017 to $2,943,155 in November 2019. Attached homes fell nearly 30% from $1,792,354 in January 2018 to $1,261,989 in November 2019. Apartments fell 20% from $1,198,693 in January 2018 to $948,538 November 2019. Many factors have contributed to the significant decline not least of which was the dramatic price increases in 2016/2017 themselves. Empty Homes Tax (1%/yr), Vacancy and Speculation Tax (0.5%-2%/yr), increased property tax over progressive thresholds, Foreign Entities tax and the mortgage stress test introduced on January of 2018 have all been contributing factors. The highest priced real estate continues to be the hardest hit and to policy makers' credit, that was one intention for much of the new taxation.

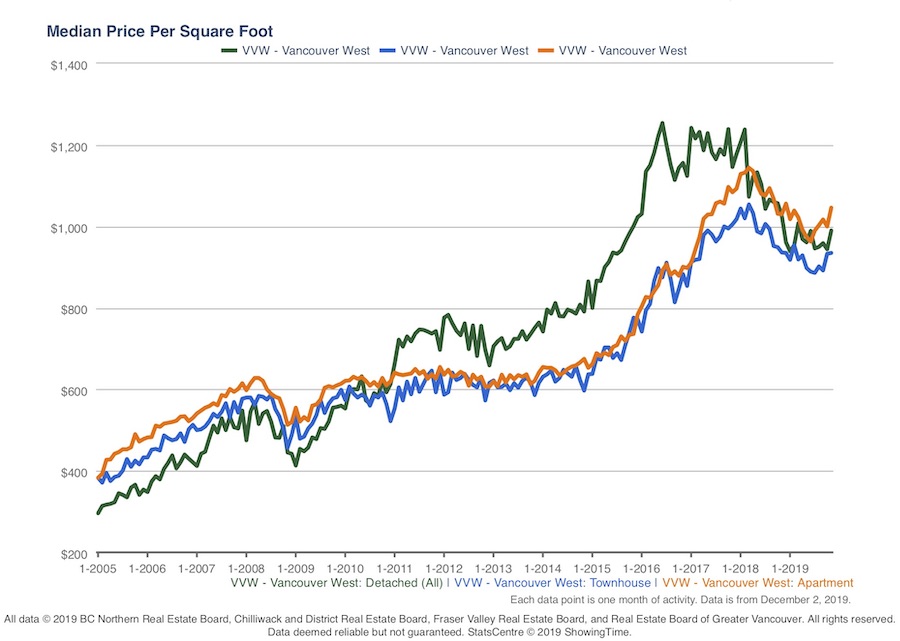

Median sale price per square foot shows us that prices have started upwards and condos are presently more costly per foot than other product types.

It has been a fairly slow year for real estate in Vancouver but prices and sales volumes both seem to have stabilized and begun to increase. Generally, volumes of sales, active listings and sale prices fall in December and we can reasonably expect to see that happen again this year. It will be very interesting to see if the end of year increase in activity of 2019 will be sustained into the Spring market of 2020.

By Sam Wyatt - Vancouver Realtor.

*Months of Inventory (MOI) is a measure derived from the number of active listings during a given month divided by the number of sales that month. It indicates the theoretical length of time it would take to sell all of the properties on the market if nothing changed. Historically, 0-5 months of inventory has generally implied upward price pressure ("Seller's Market"), 5-8 months of inventory has indicated a flat market with respect to pricing ("Balanced Market") and over 8 months of inventory has, for the most part, precipitated downward price pressure ("Buyer's Market").