Posted on

June 3, 2018

by

Sam Wyatt Personal Real Estate Corporation

UPDATED June 4 2018:

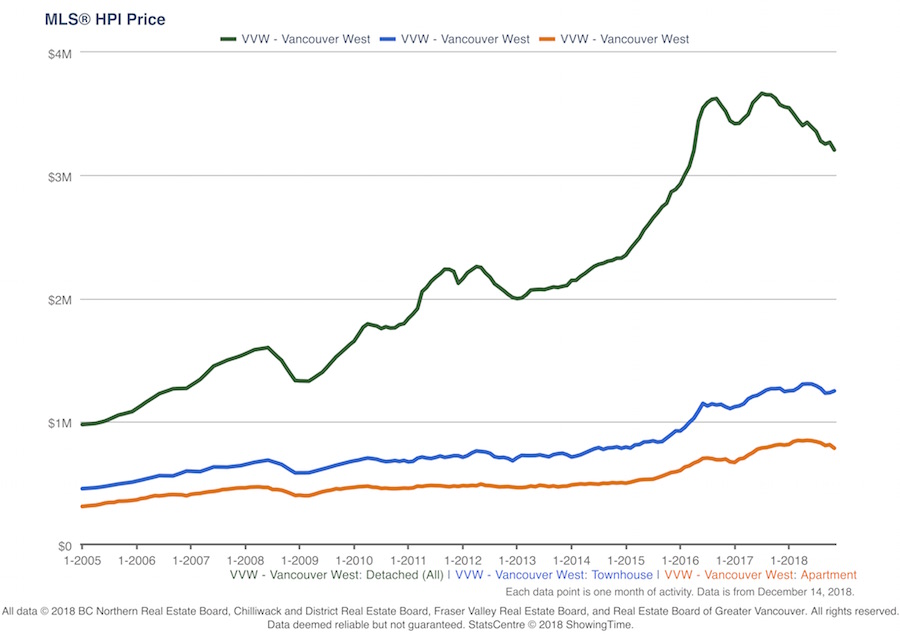

The 2018 BC budget included a suite of measures aimed at slowing the real estate market and attempting to increase residential rental stock. So many new measures added just after significant mortgage qualification rules came into effect January 1st 2018 make the chances of a declining Vancouver real estate market entirely probable. Here is a quick summary and commentary on some of the most significant measures:

Speculation tax

- New tax aimed at homeowners who don’t pay income tax in BC and who leave homes vacant.

- The tax applies to the Metro Vancouver, Fraser Valley, Victoria (CRD), Nanaimo, Kelowna and West Kelowna.

- Tax rate of .5% of assessed value in 2018

- Starting in 2019, .5% of assessed value for citizens and permenant residents who are BC residents, 1% for citizens and permenant residents not residing in BC and 2% of assessed value for foreign owners and satelitte families.

- Homes that are long-term rentals for at least 3 months in 2018 are exempt. Homes rented for 6 months will be exempt in 2019 and after.

- Citizens and permenant residents who are BC residents will receive a $2000 tax credit making a $400,000 secondary resisdence tax free.

- Exemptions also exist for owners or tenants in hospital or long-term care facility, absenses for work reasons and deceased resigistered owners while estate is being administered.

"Speculation tax" is a misnomer. This should likely have been called a "Vacant Property Surtax". In general, I like the design of this tax. I would like to have seen a full exemption for BC taxpayers for one additional property (aside from their principal residence) to ensure that vacation properties for BC residents would not be taxed at all.

Foreign buyer tax

- As of February 21, 2018, the foreign buyer tax will increase to 20 per cent from 15 per cent. It will now also cover the Fraser Valley, Victoria (CRD) Nanaimo and Central Okanagan.

- Transitional rules apply if the property is located in the Capital Regional District, Fraser Valley Regional District, Regional District of Central Okanagan, or Nanaimo Regional District, and the property sale is registered February 21, 2018 or after.

Truth be told, the foreign buyer tax has had little effect because so many foreign buyers turned to shell companies to buy Vancouver and other BC real estate. The new beneficial ownership registry rules (below) should help address this. That being the case, increasing the tax amount may be overkill.

Beneficial land ownership registry

Beneficial ownership information will now be required on the Property Transfer Tax form.

Through the Land Titles office, benefical ownership information will be publicly available and shared with federal and provincial tax and law enforcement. In addition, BC corporations will be required to hold accurate and up to date information on beneficial ownership at their record offices.

This is a good start to curb not only money laundering and tax evasion in real estate but likely also in a myriad of other industries. It probably does not go far enough. In Europe, public shareholder registries are soon to become the norm.

Property Transfer Tax

Residential Property Transfer Tax for properties above $3 million will increase to 5% from 3% effective Feb. 21, 2018. Property tax is now as follows: tax on the first $200,000 of value is 1%, 2% up to $2m, 3% up to $3m and 5% on values above $3m.

Provincial School Tax

Starting in 2019, school tax will increase on most residential properties worth more than $3 million. an additional levy of .2% on values between $3-4m and .4% on values above $4m.

This increase is likely a good way to raise tax without angering the majority of the province but with the average price of a detached home on the Westside between $3.5-4m, a lot of people will be affected there. David Eby may have a harder time getting elected in 2021.

Database on pre-sale condo assignments

Developers will now be required to collect and report information about the assignments of contracts for pre-sale condos. The province will share information with the Canada Revenue Agency (CRA).

This is in line with a significant increase in CRA enforcement of taxing gains on assignments. Most of these gains are considered income rather than capital gains so there is a lot of loot for both the provincial and federal governments here.

Online Accommodation PST and MRDT

The province struck a deal with AirBnb to collect and remit the Provincial Sales Tax (8%) and Municipal and Regional District Tax (Hotel Room Tax- 3%). The rules are not yet clear but it appears that the previous exemption for 4 units or fewer will no longer apply.

This is a good idea and goes hand-in-hand with the City of Vancouver's new bylaw (effective April 2018) allowing residents to rent out their homes when away while still restricting the use of property exclusively for short term rental. Longer term (31days+) stays using the AirBnB platform will not be taxed as well. It would be great if the province could work with the CRA to clarify rules around short term rentals of a principal residence to ensure that owners don't get caught up in a mire of "deemed dispositions". A simple CRA maximum of perhaps 90 days on short term rentals of principal residences where, if not exceeded, are clearly defined as "incidental" to the primary use as a residence would be a clean solution.

Agricultural Land Reserve (ALR)

The Agricultural Land Commission Amendment Act will make ALR land in the Lower Mainland, Fraser Valley, the Okanagan and Vancouver Island (zone 1) far more strictly protected. Areas outside of these (zone 2) will allow for more flexible use of the land aside from only agricultural uses.

Farmers hoping to cash in will not likely be glad for this focus but with only 5% of BC's land mass being good agricultural land and global warming, this seems like a "no-brainer".