Mobile: 604-722-3734

sam@samwyatt.com

Stilhavn

36 East 5th Avenue

Vancouver, BC, V5T 1G8

In January, Months of inventory (MOI)* for detached Westside Vancouver houses was at its highest point since the Credit Crisis of 2008. The spring market brought it down to 3.3 months in May but as of July it was up again to 9.88 months.

Apartments and attached homes have remained low relative to the last decade's figures. Apartments were at 1.97 and attached homes 3.46 months in July.

The Westside apartment market has been the hottest segment of Vancouver's real estate market of late. It is reflected in the narrowing price per square foot between apartments and detached homes. The difference per square foot between houses and apartments is presently only $108/sq.ft. Contrast that with the $364/sq.ft. spread in May 2016.

The story of the present market is most easily understood when looking at the Active Listing volumes graph. Active listings for apartments in particular have been at ultra-low levels compared with recent history. Meanwhile, detached homes' active listing volumes have been on the low end of normal but continue to creep into levels that have been typical for Westside houses.

Sales volumes have been pretty typical for apartments and attached homes in the past few months. House sales had been quite low since last fall relative to the previous decade until this May when 187 Westside houses were sold. Two months later in July, only 74 were sold.

The Real Estate Board of Greater Vancouver's HPI Price for Westside houses took a significant dip during the low sales period between fall and winter 2016-17. The hot apartment market this Spring brought it up to a new high point of over $3.6m in July. With active listings up and sales volumes down for houses we may see a repeat of the camel's back pattern we saw in the HPI Price between late 2011 and ate 2012.

In spite of a slower market for detached homes there is no way to dispute that Westside house prices have remained impressive. The average sale price for a detached home was a staggering new record high of $4,460,484 in July. New taxes (existing and proposed) for foreign buyers and vacant homes along with fears about rising interest rates and increasingly tight mortgage regulations may mean a slowdown in the fast pace of the apartment market. For now, the market is hot (particularly for apartments) and it remains a great time to sell. There have also been some good opportunities to buy houses in both Vancouver East and West. Do please let me know if I can be of service for you or someone you know in serving to sell or acquire a home.

By Sam Wyatt - Vancouver Realtor

*Months of Inventory (MOI) is a measure derived from the number of active listings during a given month divided by the number of sales that month. It indicates the theoretical length of time it would take to sell all of the properties on the market if nothing changed. Historically, 0-5 months of inventory has generally implied upward price pressure ("Seller's Market") for the ensuing six months, 5-8 months ("Balanced Market") of inventory has indicated a flat market with respect to pricing and over 8 months of inventory ("Buyer's Market") has, for the most part, precipitated downward price pressure.

Months of Inventory (MOI) rose to 6.25 months for detached homes in January in Vancouver's Westside.

MOI was 2.17 and 1.47 months for attached homes and apartments respectively. While MOI has been in sellers' market territory for the past year for apartments and attached homes, detached homes have been mostly in a balanced market range over the past 12 months.

The Active Listings chart helps explain what has been happening. While apartment and attached home active listing volumes have been well below normal levels, detached homes have remained within typical volumes compared to the past decade.

With the exception of the autumn of 2016, sales volumes have been fairly routine since last spring.

House prices saw a drop in the winter but have mostly rebounded as indicated in both the Average Sale Prices chart and the Real Estate Board's HPI chart.

The effect of rising prices in the apartment market while the detached market has slowed is that the expanding difference per sq.ft between apartments and houses has begun to narrow. In June 2016 the median price per sq.ft for houses was $1254 and apartments was $875; a difference of $379/sq.ft. In June 2017 the spread has shrunk to only $202/sq.ft.

Anecdotally, the fabulous weather we have been enjoying after a tough winter and spring appear to be slowing the market a little as everyone scrambles to enjoy some vacation. Looking forward, I expect we will see the apartment market continue to be strong while active listing volumes remain so low.

*Remember that Months of Inventory (MOI) is a measure derived from the number of active listings during a given month divided by the number of sales that month. It indicates the theoretical length of time it would take to sell all of the properties on the market if nothing changed. Historically, 0-5 months of inventory has generally implied upward price pressure ("Seller's Market") for the ensuing six months, 5-8 months ("Balanced Market") of inventory meant a flat market with respect to pricing and over 8 months of inventory ("Buyer's Market") has, for the most part, precipitated downward price pressure.

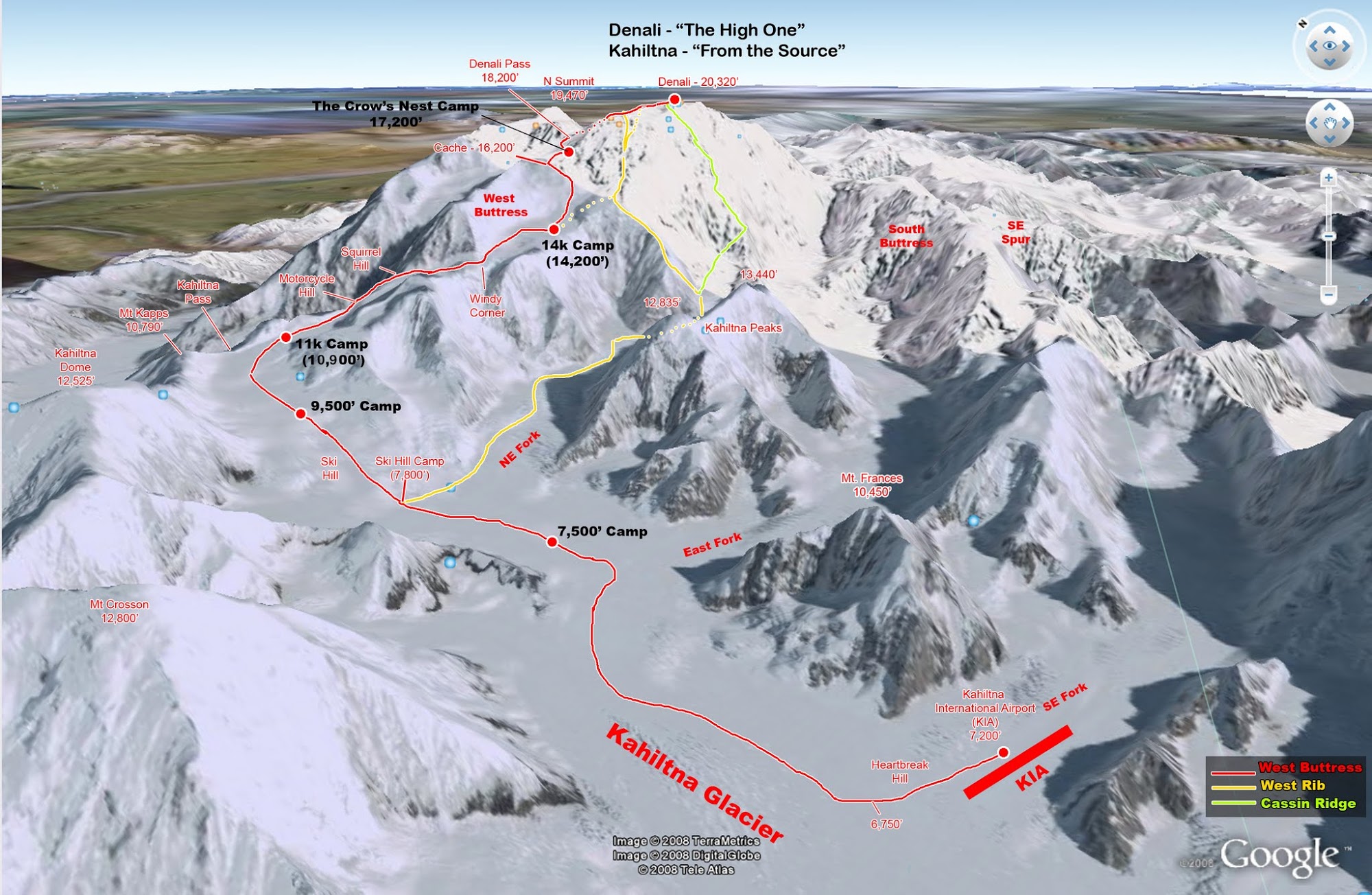

"The Aborted Cassin" or "The Tale of two Tashis"

Route anotations image with permission from and thanks to Mark Thomas - http://www.markpthomas.com/

My friend Chris Guest with whom I had climbed the Standard West Buttress Route on Denali (6190m) with in 2008 (and Everest in 2009) hatched a plan back in 2015 to try to climb the more technical Cassin Ridge on Denali in the spring of 2016. Worries (well founded) about weather related to El Nino in 2016 resulted in us not going until 2017. Unfortunately Chris was unable to come due to a move abroad so my local buddy Jerry Evans and I set out on June 2nd 2017 to Anchorage to give it a go.

Me and Chris Guest on the Summit of Denali in 2008

We arrived in Anchorage with sunny weather in the early afternoon. We grabbed our bags and were picked up by our shuttle service who took us to REI to buy cannister fuel. After about a 2 hour drive we arrived in the cute town of Telkeetna and were dropped off at the air taxi service with our gear. We checked in to let them know we were in town and ready to fly in the morning and then set to repacking our bags (regular commercial airlines have standard bag weights of 50lbs while the air taxi allowed for 80lb bags). While organinzing our gear I could not find my boots and then realized that I had forgotten to pick them them up at the airport! For those of you reading this in the know, I "Franked" by boots. Because of the tight baggage rules since my last trip to Denali in 2008 we had taken pains to maximize our loads and I had taken advantage of an airline rule that allowed a ski boot bag not to count as a bag if travelling with skis. I had never travelled with a boot bag and simply forgot to wait for them. The logistical pain of trying to get the boots from Anchorage to Telkeetna by the morning was weighing heavily on me and the many scenarios possible dogged my mind. After spending quite a bit of time on the phone trying to contact the airport and airline without getting any actual person on the phone, it was clear that things were not going to be easy. It was truly embarrassing to call my wife Jen to ask her to help make calls when she herself (for those who know her) would absolutely never have failed to remember a bag. We were hungry and so we decided to walk into town to get some food and continue to work on it.

Takeetna's "downtown" is a US National Historic Site consisting of early 1900's buildings.

We decided to go to the Twister Creek restaurant attached to the Denali Brewing Company. Shortly after walking in I ran into a friend named Joe Kluberton who is the ex-boyfirend of Jen's cousin Sandy's friend Emma! Yes, a long connection but I had been rock climbing with him in Squamish last summer. Joe lives in Talkeetna in the summer and organizes logistics for the Alpine Ascents guiding operations on Denali. Joe invited us to join him and some friends at a table. After relaying my troubles to the table, a very affable guide named John Race said that he had some clients flying into Anchorage that evening and that he could send out an email to see if anyone could help. Wow - nice people! One of John's crew in Anchorage named Tom Lawrence drove to the airport that night and doggedly was able to get the airport police to find out who could help though they could not until the following day... Tom passed the torch to Tim Campbell who swooped in the following morning, got my boots and had them to Talkeetna by early afternoon. This experience reminded me that it is a small world filled mostly with fantastic friendly people. I can not wait to pay some of this kindness forward.

The DeHaviland Otter we flew into the glacier in.

The weather in Talkeetna was spectacular and we were able to fly into the glacier about 45min after my boots arrived. The seasonal "runway" on the Kalhiltna Glacier is often refered to as the "Kahiltna International Airport" and like most popular high-altitude mountains it is frequented by people from all over the world. It lies, give or take, at about 7200' in elevation. Not wanting to hang around long, we rigged our sleds with the 125lbs each of gear that we had and began to ski down the gentle "Heartbreak Hill" that receives its name from being the sting in the tail after decending so far on the return trip only to have to finish by going up. After decending Heartbreak Hill, the route up the glacier very gently rises until about 9700' just bellow the "Ski Hill" where, after a long ski we gladly unhooked our sleds and set up the tent.

Hauling Sled

I set up the Jetboil Joule hanging stove and got ready to melt some snow. I lit the stove, opened the valve a little and watched in horror as the valve control stem started leaking out fuel, I quickly turned it off but too late, the spitting fuel from the leaking valve caught fire and we had a fire hanging from the ceiling of our tent. I detached the stove and jettisoned the stove out the open door where it gratefully went out. I have since reviewed the Jetboil Joule system and although the many design ideas of this inverted, liquid feed canister stove are great, the actual finished design is riddled with flaws starting with the ridiculously long valve stem that it just begging to leak - do not buy one. Gratefully we had brought not one but two light weight backup stoves. The GSI 4-season stove worked great though we no longer had a hanging stove to use. After the long day and the stove saga we were ready to sleep.

Looking up toward the "Ski Hill"

We spent the following day sleeping late, eating and generally talking about our strategy. We decided to spend another night at the Ski Hill camp but to leave no later than 5am the following day to avoid being out in the blasting sun that was gracing us. Unlike most mountain trips, a summer expedition to Denali does not require the use of a headlamp. Because of the high latitude it is never dark out and instead one needs to employ the use of eye covers to keep the light out while sleeping. I pulled mine on and went to sleep about 10pm.

We were woken at about 4am by the sound of a helicopter landing at the lower end of the camp. We got out of the tent about an hour thereafter, cached some food and fuel (should we need them on an aborted trip from the Cassin where we might need to descend the NE fork of the glacier) and I set off on my skis to dump our "dog bags" in a crevasse near the camp designated for that purpose. About another 200m down the glacier from the crevasse I could see about 10 people standing around. I did not see a helicopter and no one was waving so I dumped our "bio bags" into the crevasse and skied back to the tent.

The individual use bags we lined our "Clean Mountain Can" or "CMC" (portable outhouse) with - essential equipment.

We skinned up to the 9500' camp and arrived early in the day. We spent the day lounging in the tent waiting for things to cool down. In the mid afternoon the owner of and guide for Mountain Trip, Bill Allen (great guy) who we had met on our flight in was skiing up with some clients to make a cache. I said hello and he said "you missed all the action this morning". I asked what happened and he explained that a climber had fallen into a crevasse and the several Rangers with chainsaws had been flown in to get him out as he was too stuck to be simply hauled out! You can read the Park Services report here and news articles here and here. It was a note to self to make sure we traveled at night on our way down the mountain on our return when the lower glacier would be even warmer. Also one of many reasons to be on skis rather then much less weight distributing snowshoes.

Early the next morning we packed up and began the ascent up to the 11'000' camp. We were pleased when we finally arrived and set up camp right below the steepest hill yet - Motorcycle Hill, its moniker a tribute to steep hill climb motor cycle racing. It is not as steep as that but with a heavy sled, it felt like it. We decided to leave early again the next day to ferry a load of about half our gear up to the 14,000' camp where we would cache it. Jerry left his skis at 11k and I packed mine on my sled. The route between 11k and 14k consists of several steep steps with longer sections of easier terrain in between. Motorcycle Hill is followed immediately by Squirrel Hill after which there is the much gentler grade of the "Polo Field" followed by another steep hill up to "Windy Corner". From Windy Corner, there is a traverse across a side slope and then easier terrain up to the camp. The sleds were heavy enough going up Motorcycle Hill that Jerry expressed his concern about slipping as the weight of the sleds conspired to pull us down.

The 11,000' camp looking up at Motorcycle Hill - that doesn't look so bad in the photo!

We slogged up the hills and stopped to eat at a location several teams had cached gear between Windy Corner and the 14k Camp. We ate some food sitting in the sunny but cool weather compared to the 11k camp. After a little food, we carried on up to 14k and sat for a rest on our sleds. Once recovered we found a hole where someone else had dug up a cache and pushed our gear into it and buried it with snow. Three bamboo wands taped together with a red "Tuck" tape flag marked our cache. We discussed how to get down, I had my skis but Jerry did not. I figured I would take the sleds down but Jerry would hear none of it and volunteered to take them down so I could enjoy the ski down - thanks Jerry! We descended together with crampons until we crossed several significant crevasses below the camp and then seperated. I locked my Procline touring boots into ski mode and set off. Wow, it was an amazing ski back down to the 11k camp. After hours of dragging the sled up, it took only about 15 minutes to ski down. Once in camp I set to melting snow for water while feeling bad that Jerry had to trudge down without skis. Jerry arrived in good spirits saying that the sleds had been no bother at all and that the walk down had been great scenery, something I had noticed less in my more hurried mode of transportation.

Skiing from 14k down to 11k

We spent the next day in the 11k camp to rest. I went for a short skin-up and ski down the slope connected to Motorcyle Hill for fun. The snow was great but the visibility was so so.

The next day we set out early again to carry our remaining geat up to 14k to stay. The weather that day started out crisp and clear like all our previous ones but by the time we got to the top of Squirrel Hill snow had started to fall and the wind had begun to blow. By the time we reached the bottom of Windy Corner the wind was howling and visibility was extremely limited. We persevered through the gale. It definitely lived up to its name, upon rounding Windy Corner the wind died considerably and snow stopped blowing. I had not been wearing goggles and had my head down following Jerry the whole way - thanks again to Jerry!!

Getting close to 14k camp

We were grateful and tired when we arrived in the 14,000' camp. We stomped out a tent platform with the help of some friendly folks from Seattle in an adjacent tent site then rested, set up the tent, rested, threw our gear in the tent, rested, blew up our air mattresses, got in the tent, rested, melted snow while resting, cooked dinner, ate and went to sleep.

The views at 14'000 were so so

The plan at 14,000' was to stay put a day or two and settle into the altitude a bit. The next day I skinned up and skied down the slope heading up to the West Buttress ridge a few times from just shy of 15,000'. We met a few other teams including some others planning to climb the Cassin Ridge. In talking with the Rangers and other teams we came to know of two groups that had been 3 days overdue from the Cassin who had been "worked" on the route. One team had lost their tent poles and after wading through waist deep snow to the summit ridge had spent a night out in a snow cave below the summit near the "Football Field". They had been out high on the mountain in the weather we experienced at Windy Corner on our final push to 14k. Up high the temperatures would have been close to -40 and winds gusting up to 45mph that day. Hearing these tales solidified our resolve that we would only head onto the Cassin if a weather forecast of at least 4 days of high pressure came. We still needed to acclimatize and so the next day we made a foray up to 16,200' at the top of the fixed lines heading 17,000' camp.

Ascending the fixed lines up to the West Buttress

The day after we rested in 14,000' and met Tashi, Tashi and Sanjay of Nepal. It turns out the each of the Tashis knew a different Nepalese friend of mine. It was neat to have another small world moment and we compared notes on who else we might know. Sanjay was mostly in the tent with a cough, bad enough that Jerry thought might be a lung infection.

On June 15th, we decided to head up and spend a night at the 17,000' camp and weather permitting to take a walk out towards the summit to help with our acclimatization for the Cassin. Once at the top of the fixed lines, the traverse across the ridge up to the 17k "Crow's Nest" camp is quite aesthetic.

Ridge heading to the Crow's Nest camp

We were quite tired on arrival to 17k but the weather was sunny (though cold) and we were able to set up our ultralight tent (we left our larger tent at 14k) without much trouble. We could see that the upper mountain was quite windy from all the blowing snow off it. The Nepalese guys showed up about a half hour after us and set up next door again.

The Tashi's setting up their tent (left); me setting up ours (centre). The "Autobahn" is the snowy slope above our tent.

The next morning the tent was frosted in like a freezer from all our breathing. It was another beautiful but still very cold day. Although the wind was quite high again on the upper mountain it was fairly sheltered up the "Autobahn" to Denali Pass so we decided to head up for a walk and turn around when we got too cold or tired.

Always a joy to wake with frost falling from the ceiling

The diagonal slog up the Autobahn to Denali pass was slow but fine and when we reached the pass we decided to continue on. It was cold - very cold and windy. I pulled out my down mittens with additional fleece liners which is kind of a big deal as I have litterraly never used but only carried them as backup on summit bids before (including Everest), preferring gloves. With my Goretex suit, two down jackets, puffy pants, goggles, cashmere balaclava, boots, over-boots and double mittens, I actually felt pretty cozy. The forecast had been calling for temperatures as low as -40c and wind of 30mph that day, I am not sure what the temperture was nor the wind but it was cold. We trudged on.

After a couple more hours of slow moving we were passing up a gentle incline just before the "Football Field". There I saw some really amazing snow/ice formations that looked like stemless wine glasses formed by the wind and sun. One of these formations looked almost exactly like a skull shaped Ghostface mask though the "eyes" where more rounded. It was a little disconcerting and I got a feeling that something bad might happen or that someone might die. I wanted to take a photo but my "camera" was my iphone and I was not taking off my mitts to put my exposed finger on the screen to take it. Unfortunately neither of us have any photos of that day out due to the cold. In spite of the bad omen, I did not get the kind of "red stoplight" intuition experience that would make me feel I was in any real danger so we carried on.

After crossing the Football Field we arrived at the base of "Pig Hill" - the steep hill leading up to the summit ridge. At its base, we met Tashi, Tashi and Sanjay! We had not known that they had left earlier in the day and they were on they way home from an apparent successful summit. The two Tashis were on either side of Sanjay holding his hands and at first it looked just like classic Nepalese friendship. As we got closer it was clear that Sanjay was struggling but moving. They told us we were about 45min from the summit. I looked up and remembering 2008 and feeling as I did, guessed that it was more like 2hrs. I asked them how they were and they said "tired" and quickly continued down. Two other climbers, Jeff and Priti, were above us climbing Pig Hill. They had been on the mountain for a week longer than us and were clearly better acclimatized and moving significantly faster. Resigned to carry on we began to grind up the hill. About two thirds of the way up the hill I watched as Jerry kind of laid out sideways stretching his arm. It looked a little odd and was followed up by Jerry yelling "Do you want to head down?". By this time most of me was warm but my left foot was really cold. I yelled up an emphatic "Yes!" and we began our descent.

At the base of the hill I clipped my ice tool onto my harness, pulled out my ski pole and we sauntered back across the Football Field and down. When we arrived above the step section descending to Denali Pass I reached onto my harness to grab my ice tool to find that it was not there... A little shocked I realized that it must have somehow worked its way off the carabiner (note to self - use a locking 'biner next time). I decided to wait for Jeff and Priti who were returning about 10 minutes behind us (having made the summit) to see if they had picked it up. "Did you guys by chance see a Black Prophet ice tool?" I asked. "Yes, right at the bottom of the Football Field; I swung it into the snow securely for you" Jeff replied. OMG, I don't know what he thought I might want to leave an ice tool high on the mountain for but it was hard to get angry when it is me who had lost it.

I was not excited about descending without a tool which is the safety margin that allows a climber to self-arrest if they fall but what could I do? We reduced our rope length to about 12' and we began slowly descending after Jeff and Priti, I carefully placing my feet and using my ski pole for additional support. As we neared the end of the Autobahn I could see ahead the Nepalese party and it was clear that one of the climbers was not on his feet and the other two were attempting to lower him. When we got close enough to talk I could see that Sanjay had a rope tied around his chest and Tashi was attempting to lower him on an axe belay (rope wrapped around the shaft of ice tool that was driven vertically into the snow). The other Tashi was beside Sanjay trying to shift him sideways as the route curved around the base of a rock rib and the was a crevasse below them that they were avoiding. The situation looked desperate and what was a 10 minute walk downhill was going to take them a couple of hours at the rate of progress they were making. I pulled out my whistle and blew it three times, paused and repeated. We could see camp and we saw a Ranger emerge from a tent below. I waved my arm and sent three more blasts. I then asked "Is it his head or lungs?" Tashi said it was his lungs. I pulled out my mini medicine kit in which I had drugs for both cerebral and pulmonary edema. I tossed the bottle to Tashi (beside Sanjay) who caught it and I said "give him two of the YELLOW pills" (it was nifedepine for pulmonary edema). I could hear Jerry telling tashi (above) that we would decend and get the Rangers, which we proceeded to do.

In the 10-15 minutes it took us to descend to the camp I used the SOS function on my Delorme InReach satellite communicator. We got to the Ranger encampment and several of the Rangers were getting gear on. We were ushered into their tent where we explained what was happening above. They thought that Sanjay might be able to be "short-roped" where he would be tethered to a climber and supported while he walked down. I made it clear that he was not going to be able to walk. I said "no way, he is fucked, he will need to be taken out on a sled". During the last hour, we had not had anything to drink as our water bottles were frozen shut. I, only half jokingly, said "we need to go get some water or we are going to have a couple additional casualties" to which the Ranger replied "thank for your help guys, go and take care of yourselves". Walking across back to were our tents were we ran into one of the Tashis. I was surprised to see him as I would have expected that they would need to stay with their friend. We told Tashi that the Rangers were mobilizing for the rescue. He asked where they were and we pointed to several figures putting on packs.

Back in the tent at 17,000' after alerting the Rangers - worn and worried.

Once back in the tent we warmed our water bottles and got something to drink. I looked at Jerry and said "he is probably going to die". I opened up the InReach and responded to the replies from the SOS service and explained that the Rangers were now alerted and effecting a rescue. It was about 1:30am and I was exhausted. Knowing that the Rangers would do all they could we went to bed. In the morning I woke up and Jerry said "bad news; Sanjay died". The Rangers had returned to the Nepalese tent about an hour after going to sleep. Jerry had still been awake and overhead the Ranger explain to the Tashis that when they (the Rangers) arrived to Sanjay that he was unresponsive and had pulled off his coat (common symptom of altitude related edemas and hypothermia). They attended him but he ultimately died. I was a little shocked to hear that both Tashis had descended to the camp and left Sanjay alone but who knows what condition they might have been in themselves. I only know that I felt bad going to bed myself and would certainly not have done so if Jerry had been the casualty. Looking back at what we could have done differently it starts with when we first saw them at the bottom of Pig Hill. In retrospect, I wish that I had inquired more deeply into Sanjay's condition and offered them my medicine stash while he was still ambulatory - just in case. Maybe we should have made friendly inquiries at the 14k camp and gently remined them that going up would be a bad idea for Sanjay. I also wish that I had administered the medicine to Sanjay myself. In speaking with Tashi later I learned that they never gave it to him. I would also have given him both dexamethasone (for cerebral edema) and nifedepine (for pulmonary edema). Once incapacitated it is difficult to know for certain which ailment one has subcomed to and with death being the likely outcome if they can't decend quickly, there is little risk in giving the "wrong" medication. I still really feel like we could have done more and that chaffs because I feel like I have learned the lesson of earlier intervention more than once. I hope there is no "next time" but if there is I pray I can be of better service. That morning we along with almost everyone else pulled out of the 17,000' camp to descend to 14'000' as the forecast was calling for more wind.

Above the 14,000' camp

We carefully descended the ridge and the slope above the 14k camp. I still had no tool (2nd tool was at the 14k camp) so it was a little slow as I took extra care. Life was much better at 14,000'. It was warmer and the camp was far better protected from the wind that was hammering the upper mountain. We lounged around until I saw Jerry looking at his nose in a mirror he looked up and I could see that his left nostril was black - frostbite. It did not look too bad but I told Jerry to go see the med tent and see what they thought. I said I was happy to stay and wait for it to heal or to depart, that it was up to him. About an hour later he was back and with a heartfelt pat on my back he said he was sorry but he needed to go home. It was a good call and exactly what I would have done. No point in risking making it worse and losing some nose over a couple of week mountain trip! I knew that my wife Jennifer would be overjoyed to hear that I was returning early as she was suffering from a flare of her autoimmune condition. This is the way it goes in the world of high altitude climbing - sometimes you don't even get on the route you intend to climb. The Cassin will have to wait and maybe a long time.

Jerry looking pretty weathered - nostril now red rather than black

Waiting for the plane to take us back to Talkeetna

The smiles of people who know that food and beer await!

Almost all the photo credits to Jerry Evans!

The last couple of months in the Vancouver real estate market have been a wild ride.

Months of Inventory (MOI) reached over 15 months for detached homes in January in Vancouver's Westside. This is the highest it has been since the 2008 credit crisis. MOI in April sat at 5.43 months for detached homes, 2.13 months for attached homes and only 1.44 months for apartments.

While active listing volumes for detached homes are about the same as they were in April, the sales volumes are less than half. Apartments have been the hottest segment of the market. Lower active listing volumes coupled with average sales volumes have created multiple offers and rising prices.

The rising prices of apartments and attached homes are gradually diminishing the spread between themselves and houses per square foot. In June 2016 the difference was more than $350/sq.ft. it is now less than $200/sq.ft.

Apartments, particularly lower value apartments have been a hot commodity. Anecdotally, my last four condo listings all quickly sold in multiple offers well over their original listing prices.

Looking forward it is unclear if we will see a recovery in house prices soon or not. Apartment pricing can not likely rise much more before either stalling or house prices rising too. It seems more likely that we will see apartments hit a ceiling mirroring the slow down in house sales that we saw last fall rather than a new surge in house prices.

*Remember that Months of Inventory (MOI) is a measure derived from the number of active listings during a given month divided by the number of sales that month. It indicates the theoretical length of time it would take to sell all of the properties on the market if nothing changed. Historically, 0-5 months of inventory has generally implied upward price pressure ("Seller's Market") for the ensuing six months, 5-8 months ("Balanced Market") of inventory meant a flat market with respect to pricing and over 8 months of inventory ("Buyer's Market") has, for the most part, precipitated downward price pressure.

By Sam Wyatt - Vancouver Realtor

Months of Inventory (MOI) for Vancouver West detached homes fell to 6.59 months in December - right in the middle of a "balanced" market range. Apartments and attached homes saw their MOI rise but both remain well under 5 months in "Seller's" market territory.

Active listings volumes remained persistently low for most of 2016. These low active listing volumes helped facilitate huge price gains in 2016.

Sales volumes fell to 237 homes in December 2016 for Westside apartments. This is within a pretty typical range for December sales in the past decade. Attached homes sales volumes dropped to 64 in December which is the low side of typical. The most dramatic sales volumes drop was for detached homes on the Westside. They fell to only 23 homes - the lowest monthly sales since the middle of the Credit Crisis in Januay 2009 when only 14 homes were sold.

In September I predicted that we would see average pricing for detached homes fall by 20% from their high point by December and then rebound in the Spring. Average sale prices for houses did fall 18% between the months of July (their high point) and October 2016. They rebounded to about only 12% down as of December from the July high point. In spite of low sales volumes I think we may see house prices continue to slowly recover into the Spring.

The Real Estate Board's HPI Price for the Westside shows a more modest reduction in prices for the "typical" home.

The median price per square foot more closely resembles the average price changes.

We should have some sense of how much influence Chinese capital will have in 2017 in Vancouver by February. Lunar New Year is January 28th and the Chinese national holidays that follow it have typically been the flash point for Spring markets over the recent past.

My prediction for 2017 is not to expect the price increases of 2016 but similarly don't expect the sky to fall. Those of you aiming to sell who have spoken with me know that we should be aiming for February/March to begin listing.

*Remember that Months of Inventory (MOI) is a measure derived from the number of active listings during a given month divided by the number of sales that month. It indicates the theoretical length of time it would take to sell all of the properties on the market if nothing changed. Historically, 0-5 months of inventory has generally implied upward price pressure ("Seller's Market") for the ensuing six months, 5-8 months ("Balanced Market") of inventory meant a flat market with respect to pricing and over 8 months of inventory ("Buyer's Market") has, for the most part, precipitated downward price pressure.

By Sam Wyatt - Vancouver Realtor

Months of Inventory (MOI) was down for apartments and attached homes and slightly up for detached homes on Vancouver's Westside in November. Detached homes hovered on the cusp of a "balanced" and "buyer's" market while apartments were in a "seller's" market.

Compared with the past several years, active listing volumes remain quite low. it is this lower active listings number that helped fuel the hot market we had this spring. Active listings are certainly higher now than their most recent low point of January 2016.

Sales volumes have rebounded slightly since October. Typically, at this time of year we see sales volumes continue to fall so the uptick in November may indicate some pent up demand by those who were waiting to see what the effect of the new Foreign Buyer's tax might have. My own experience is that I have many buyers waiting for an opportunity.

The Real Estate Board of Greater Vancouver's HPI Price for the Westside had prices falling slightly in November 2016.

The average sale prices show that November had a little bit of a boost. Looking ahead I continue to see a week December and January with some resurgence in the spring market of 2017. Those of you planning to sell should be ready to list in February or March to maximize the benefits of the spring market. For buyers, you should be looking for good deals now and January as many listings stagnate into the new year.

*Remember that Months of Inventory (MOI) is a measure derived from the number of active listings during a given month divided by the number of sales that month. It indicates the theoretical length of time it would take to sell all of the properties on the market if nothing changed. Historically, 0-5 months of inventory has generally implied upward price pressure ("Seller's Market") for the ensuing six months, 5-8 months ("Balanced Market") of inventory meant a flat market with respect to pricing and over 8 months of inventory ("Buyer's Market") has, for the most part, precipitated downward price pressure.

By Sam Wyatt - Vancouver Realtor

Will returning dual citizens and Canadians disaffected by the Trump presidency buoy up prices? Gratefully, Trump's acceptance speech did not start with a "lock her up" chant and it might be that he puts his most crazy thoughts back in storage for four years. There are certainly many who have said they would move home in the event of a Trump win but I suspect that human lethargy will prevail and that the impact on the real estate market here will be minimal. There may well be more ridged policy implemented around NAFTA visa processing for Canadians but this will take time if it happens at all.

Months of Inventory (MOI) fell for detached Westside Vancouver homes but continued to climb for attached homes and apartments in October. Detached homes stepped back from "Buyer's market" territory. Detached and attached homes are presently in a "balanced market" while apartments remain still in a "seller's market".

Sales volumes increased slightly in October for detached homes but continued to fall for attached homes and apartments. If history tells us anything it is that sales volumes will probably fall for all homes types in November and December.

October active listings grew for apartments and attached homes but fell for houses. Like sales volumes, we can anticipate active listing volumes to fall over the coming months.

The quick rise in MOI in August and September helped precipitate a significant drop in average sale price (from $4.269m in July down to $3.517m in October) and a modest decline in the HPI index for detached homes.

A slight uptick in median price per square foot for detached homes in October may indicate that house prices may be on their way to stabilizing.

I suspect that the market will continue to wind down into January. It remains to be seen what will happen in the Spring market of 2017. Presently I believe that we will see modest price rebounds and a more subdued pace then we have had in 2016.

*Remember that Months of Inventory (MOI) is a measure derived from the number of active listings during a given month divided by the number of sales that month. It indicates the theoretical length of time it would take to sell all of the properties on the market if nothing changed. Historically, 0-5 months of inventory has generally implied upward price pressure ("Seller's Market") for the ensuing six months, 5-8 months ("Balanced Market") of inventory meant a flat market with respect to pricing and over 8 months of inventory ("Buyer's Market") has, for the most part, precipitated downward price pressure.

Months of Inventory (MOI) rose again in September to just shy of 11 months for detached homes. While MOI for both attached homes and apartments remained at historically low figures of 3.41 and 2.65 respectively, they both have upward trending trajectories. Sales volumes have been declining since things peaked in about March or April depending on home type.

This is a pretty typical annual sales cycle but the pace of decline really increased in August. The resulting rise in MOI, particularly for detached homes has put downward pressure on house prices. The annual low point for sales volumes is typically December or January so expect to see volumes to continue to fall. With only 60 detached sales of Westside houses in September we are on track to better December 2012's low point of 49 sales. I don't expect us to beat the November 2008 low of 21 sales.

I am generally a fan of the Real Estate Board of Greater Vancouver's HPI price which tracks the price of a theoretical "typical" home. This month it fails to capture what is happening. It shows detached and attached home prices leveling off and apartment prices falling. A quick look at the price per square foot sales values show exactly the opposite.

Bear in mind that over the last year prices rose 25-35% in Vancouver's Westside so it should really not be alarming if prices fall 10-15%. Presently average sale prices on detached homes have fallen less than 10% from their high point in July but I suspect that by the time December/January rolls around that they will have declined by about 15%. I do believe that pricing will stabilize and possibly even rebound in the Spring market of 2017 (I've certainly been on ther other side of this argument in the past). The underlying driving factors of incoming foreign capital (regardless of the new 15% tax) and low interest rates will very likely continue.

Active listing volumes generally peak prior to October. Active listings are on the low side compared to the past 5 years so I don't expect their volume to have too much influence on the market in the coming months.

A couple of recent announcements from the federal government are worth mentioning this month.

The first is a rule change about the reporting the sale of principle residences. Historically when one sold their home which they used exclusively for a principle residence (can claim one residence as principle for any given year) they did not need to report the sale to the Canada Revenue Agency (CRA). The new rule announced this past week requires that the sale be reported. There will still be a capital gains tax exemption on the sale of a principle residence but it must be reported. This is a smart move by the CRA to better enforce the existing rules for perennial flippers who may be considered to be engaged in the "business" of selling real estate rather than their "family home".

The other announcement was a tightening of the rules for insured mortgages. The new rule is an expansion of an existing rule for insured mortgage terms under 5 years and for those taking out a variable rate. It requires that the borrower qualify for the loan based on the Bank of Canada 5-year posted rate rather than the usual discounted rates most folks get. The new rule expands to include all insured mortgages rather than just variable rates and those with terms under 5 years. According to the Department of Finance Canada Website: "The announced measure will apply to new mortgage insurance applications received on October 17, 2016 or later. This measure will not apply to mortgage loans where, before October 3, 2016: a mortgage insurance application was received; the lender made a legally binding commitment to make the loan; or the borrower entered into a legally binding agreement of purchase and sale for the property against which the loan is secured. Mortgage loans for which mortgage insurance applications are received after October 2, 2016 and before October 17, 2016 are also not affected by the rule change, provided that the mortgage is funded by March 1, 2017. Homeowners with an existing insured mortgage or those renewing existing insured mortgages are not affected by this measure." This change is likely aimed at mitigating the risk associated with the huge (about $500 billion) insurance liability held by the Government of Canada via the Canadian Mortgage and Housing Corporation. It will definitely knock some buyers down a peg in what they can buy in Vancouver's apartment market. Because you can't get an insured loan on properties over $1m and the rule existed already for many insured mortgages, it will have a narrow but real impact.

*Remember that Months of Inventory (MOI) is a measure derived from the number of active listings during a given month divided by the number of sales that month. It indicates the theoretical length of time it would take to sell all of the properties on the market if nothing changed. Historically, 0-5 months of inventory has generally implied upward price pressure for the ensuing six months, 5-8 months of inventory meant a flat market with respect to pricing and over 8 months of inventory has, for the most part, precipitated downward price pressure.

NB: This Blog has been corrected. The existing insured mortgage rules were previously described as relating to mortgages under $500k rather than terms under 5 years.

By Sam Wyatt - Vancouver Realtor.

Months of Inventory (MOI) shot up from 5.62 to 9.79 months between July and August 2016 for Vancouver West houses; pushing MOI for houses just inside "Buyer's market" territory.

MOI had already been creeping steadily up for houses since March but the last time we saw MOI rise more than 5 months over a single month was between October and November 2008 when it jumped from 19.5 to 37.96 months (and July and August 2008 from 11.32 to 19.89) as the credit crisis was unfolding. MOI has not been this high for houses since late 2012 when it was up to over 14 months. In sharp contrast, attached homes and apartments both continue to hover just under and over 2 months respectively - historically super low figures.

Decreased sales lie squarely at the root of the sudden increase in MOI for detached homes. Sales volumes for apartments and attached homes remained robust, hence their continuing low MOI. Sales volumes have generally been falling since the super-hot month of March but the fall to only 61 house sales on the west side of Vancouver is the lowest monthly sales volume since December 2012. We need to go all the way back to 2008 to find an August with fewer sales.

The effect on pricing thus far has been negligible. In 2008 it took 7 months from the high point to the low point of the average sale price for west side houses. In 2012 it took 5 months. In 2008, the average sale prices fell about 30%. In 2012 it fell 25%. In both cases it rebounded quickly. The average sale price fell 9% between July and August 2016 and I estimate that we will see the average sale price for houses fall by a total of about 20% in the coming months. Recall that the average sale price rose more than 20% between December 2015 and July 2016 alone so this would put us back to where prices were in January 2016. The trouble for salivating bargain hunters is that one does not pay the average price for a home.

The Real Estate Board of Greater Vancouver's HPI Price is a better measure of price changes. The average sale price for Vancouver's west side is influenced by a huge spectrum of price points ranging from below $2m into the tens of millions of dollars. Generally, the costliest homes see a greater decline when prices fall. The HPI index creates a "typical" home sale price which better reflects the changes for typical buyers and sellers. In 2008 the HPI Price decline from its high to low point was only 17% and in 2012 it was only 12%. Based on these numbers I suspect that the HPI Price for west side detached homes to fall by only about 10-15% in the next several months. For apartments and attached homes it is more likely that we will see prices flatten or fall only slightly.

The big question is: why did house sales volumes fall so quickly? Sales volumes were falling from their high point in April each month until now but the biggest drop was in August. It is my opinion that the August announcement of the new 15% Property Transfer Tax for foreign entities made everyone say "let's just wait and see what happens". Because sales volumes have probably fallen based mostly on uncertainty around what is likely to be a nearly ineffectual tax tends to make me believe that we will see a similar rebound to 2009 and 2013. On the other hand, in 2008 and 2012 our market was given a helping hand by huge inputs of money into the global financial system via the US Federal Reserve's "quantitative easing" programs. It is highly improbable that such monetary stimulus will return in the short term. Last month I covered the Property Transfer Tax changes and I continue to expect foreign capital to flow to Vancouver come next spring as it has for some time now. In the meantime, those of you who are wanting to buy a detached home would be wise to be ready to do so sometime between November and January when I expect pricing to be at its annual low point. Those of you planning to sell houses should be gearing up to list in early Spring when MOI numbers have historically been most advantageous for selling.

*Remember that Months of Inventory (MOI) is a measure derived from the number of active listings during a given month divided by the number of sales that month. It indicates the theoretical length of time it would take to sell all of the properties on the market if nothing changed. Historically, 0-5 months of inventory has generally implied upward price pressure for the ensuing six months, 5-8 months of inventory meant a flat market with respect to pricing and over 8 months of inventory has, for the most part, precipitated downward price pressure.

By Sam Wyatt - Vancouver Realtor.

Months of Inventory has begun to climb, particularly of for detached housing and we are slowly moving out of an extremely frenetic market to a more typical hot market. Apartments and attached homes on the Westside continue to have very low months of inventory. Don't expect prices to fall significant anytime soon.

I have received countless requests for my opinion about what effect the various changes to the Property Transfer Tax (PTT) made this year will have so I will devote this market update to answering them. My simple answer is that the changes were likely meant only to make the government appear to be doing something about house pricing in Vancouver. One change is an appropriate step in the right direction but the other two PTT measures appear to be a give away to those who are likely funding election campaigns in one case and a sensational measure to divert attention from more effective policy options in the other.

In February 2016 the PTT rate for the fair market value of homes over $2,000,000 was increased to 3%. In principle I like this move. A progressive property transfer tax means that the more costly the home, the more steep the taxation on its purchase. There should likely be another threshold over $5m at 4% and another over $10m at 5%. The principle here is that the steep increase in taxation should help mitigate pricing. In practice, because it is a one time tax, I doubt that it will be effective even in the case of more thresholds. I would have been far more impressed with a progressive Property Surtax rather than a purchase tax - more to come on this later.

For me, the most egregious of the recent PTT changes is the exemption for new construction homes under $750,000 brought in February. If there is a group {aside from fat cat realtors like me – Ha!} who are presently making their fortunes from the present real estate market it is developers. If I "follow the money" it suggests there should have been some serious election campaign contributions from Vancouver developers because this PTT exemption looks like a pure give away to them. The government's argument for the elimination of PTT for new construction is that it makes buying a new home more affordable. The problem with this argument is that it ignores that real estate is effectively a market commodity. People will pay what they are willing to pay, including taxes, whether there are taxes or not. By eliminating the PTT on the sale of new homes, the BC government has simply padded developers’ margins who will always charge as much as they can (I do not begrudge them) - a little less than 2% more in this case.

The brand new 15% PTT on residential property purchased by foreign entities brought into effect on August 2nd is the sensational one. 15% is a large percentage and intended to impress, without actually altering the long-term market. One probable and significant short-term problem with the new tax is that it does not grandfather existing contracts. I expect that we will see some court challenges on this. It is patently unjust to retroactively apply a tax that would certainly have affected the purchasing decision. Consider again that the buyers paid as much as they were willing, inclusive of taxes, and are now suddenly saddled with a new tax. The next problem with the tax is those who should pay it likely won't. A simple dodge for this tax is for Canadian corporations to buy properties, pay standard PTT and then sell the shares of the corporation to foreign entities triggering no additional PTT at all. Lawyers and entrepreneurial types have likely already set the wheels in motion on this. With such a huge tax, the legal and remuneration costs will look quite reasonable. One possible long-term distortion resulting from this tax is that foreign entities may shift purchases to agricultural and commercial property (which are exempt), making life harder for local farmers and businesses. The more significant issue with the tax appears to be that very few entities, if any, are targeted by it in the first place. One of the missing conversations about this tax is that many of the so-called "non-resident" owners are in fact residents. There are countless examples of students and homemakers owning multi-million dollar homes for which they do not even have the income on paper to pay for the annual property taxes. In many cases the students and homemakers in question are, in fact, residents of Canada. The breadwinner of the family has, more often than not, designated themselves as a non-resident while their spouse or children hold title to the property as residents. This means that no income tax is paid while the very wealthy family is entitled to all the benefits of residency in BC. In a sense the BC government was right when they initially claimed that there isn't a foreign ownership problem - it is actually an income tax avoidance issue. The effect of foreign money on the Vancouver market is more probably attributable to residents rather than non-residents and that is the problem with this tax, it does not target the money that is influencing the market but rather a very small group of people. I suspect that it was a very conscious move to implement a tax that sounds impressive but does little.

That leaves us with the question: what would a better policy be? I am a strong advocate of a progressive property surtax proposed by both Josh Gordon at the SFU School of Public Policy and Thomas Davidoff, Joshua Gottlieb and Tsur Somerville at UBC's Sauder School of Business. The proposed tax specifically targets people who are not paying Canadian income tax but own costly homes in BC. It would be levied as part of a BC Income Tax Return and payable to the provincial coffers. income tax paid would be deductible against the surtax and there are a myriad of exemptions proposed (eg: retirees) to insure that the tax is properly targeted. The beauty of this tax is that it targets foreign capital rather than foreigners. A secondary benefit is that it targets tax evaders and avoiders. Unlike cash, you can't "offshore" real property. The proposed tax would raise significant revenue while simultaneously discouraging foreign ownership by raising the annual carrying costs. The economists from UBC and SFU made the case to the Province and were roundly dismissed. I can only speculate why a government could ignore prominent schools within the province's two most respected Universities and implement much lesser policies. I am inclined to believe that they don't really want to solve the housing crisis at all.